Get rich slow and win at universal credit with tech

He is more likely to tell you your account pays ‘two parts of bugger-all’ than UK’s Money Saving Expert.

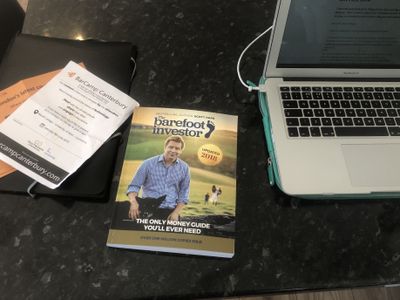

But Australia’s Barefoot Investor is a similar money guru, minus the shoes or tact.

The UK’s Money Saving Expert on the other hand, pops up from time to time on the morning ITV telly couch, and was the boss of a woman I speed-dated once.

The woman and I didn’t end up dating, but I did get five minutes of excellent money saving advice. If you are ever in need of financial or legal advice (which normally costs a fortune) my money saving tip would be to go speed-dating near the Bank of England, like I did, with the accountants and lawyers who are too busy working crazy hours to get a boyfriend or girlfriend.

Recently, I read a blog post from Jenny Wong[2] about turning around her finances. It reminded me of the book ‘The Barefoot Investor: The only money guide you’ll ever need’. My brother in Australia recommended it to me – it’s a best selling sensation over there apparently.

So I decided to write a reply to Jenny Wong, but it got a bit long, so I posted it here as a blog post instead:

Nice Read Jenny Wong!

Like you Jenny, in his book the Barefoot Investor also advocates having 3 months salary saved. Saved for, I’m reluctant to say ’emergencies’ so let’s say ‘unexpected spending’, which he calls your ‘Mojo’ account. Presumably because knowing the money is there makes you feel good.

Actually, The Barefoot Investor recommends a lot of the things you suggest Jenny – it’s almost as if you’d read the book. But it sounds like you came up with the same ideas independently – which is a good sign. That happens in nature too, and its called convergent evolution. It’s the reason our British Fox has a similar skull to the unrelated Australian Tasmanian Devil.

Recently, I’ve been playing around with [Actual Budget](http:// https://actualbudget.com/) software for budgeting.[3]

It was in Alpha stage when I started, and missing a lot of features, but it was good (and free) for making a simple budget. And the author of the software previously made Prettier – so he has enough credibility to take notice.

So many pieces of technology make the claim that they will make you, the software developer, 10x (ten times) more productive. They never do, normally you end up fighting with the tool to do what you want. Prettier actually did make me, I think, 10-20% more productive, which is a decent productivity gain.

I’ve been influenced by a TED talk I saw by Hilary Cottam about a new approach to welfare benefits. (I discovered Cottam’s website while investigating a hipster co-working space, and disused multi-story car park, Peckham Levels in South London, near me.) Also I’ve been touched by personal stories related to the introduction, by the UK government, of the new Universal Credit welfare state benefits scheme. I’m not going to get into politics here, but a lot of people on Universal Credit are having money problems because the scheme requires them to do monthly budgeting, something they previously didn’t need to do when their rent was paid automatically to the council, and they got money fortnightly.

I’ve been playing with an idea of helping people on Universal Credit by using technology, and, financial wisdom. Some combination perhaps of:

- The Barefoot Investor‘s advice

- Wisdom of the UK finance landscape[4]

- Actual Budget

- Monzo Pots or Automated bank transfers possibly using IFTTT.com

- Open Banking protocols

Don’t know what bureaucratic structure would make most sense for the project to take: not-for-profit, for-profit, company, charity, government project, or, whatever works to help people. But I reckon it could potentially get a lot of poor people out of poverty.

Anyone reading this agree and want to help make it happen? Then get in touch with me.

Footnotes

[1] Page 17, The Barefoot Investor: The only money guide you’ll ever need.

[2] Jenny Wong is the no-nonsense organiser of the WordPress London developer meet-up. While hundreds of React technology fan-boys are lining up at Facebook’s London HQ for a sold-out Advanced React event tonight (2019/05/14) that will probably feature a host in stream-punk gear, free beer, and a lot of cheering – the star of the show, React tech celebrity and reclusive genius Dan Abramov will not be attending. Instead he’ll be in a room above a pub at the unfashionable WordPress developer London meet-up. ‘How did you get Dan Abramov to come?’ I said. Wong replied, (I‘m paraphrasing): ‘I just asked. I used to work in Starbucks for years. People are just people. Also, remember, when we threatened not to use React in WordPress [WordPress powers a third of the web], Facebook changed their open source license for us.’ This effectively made React free for anyone to use, from corporation to schoolchildren, without getting sued. Thanks WordPress.

[3] After getting made redundant from one of those failed technology start-up companies you hear about in the footnotes of the technology news (update 2018: it didn’t even make the footnotes), I suddenly got interested in budgeting. Interesting, unexpected insights. I thought I’d end up cancelling things like my Netflix subscription or Amazon Prime to save money. Nope. Looking at the Actual Budget data, I discovered going out, and eating out, were my biggest lines of expendable income I could save on. By staying in, and watching Netflix for a few pounds a month, I was saving money over drinking beer in London pubs for a few pounds a half-hour. Learning to cook, and eating cheaply, would be my biggest saver. More on that in a future blog post. Or get the book [Ad] The Urban Hermit by Samuel A. MacDonald [End of Ad] from your local library (ISBN-10: 0312429150), that’s what I did last time I was broke.

[4] I used to volunteer at a rough inner-city youth club in Brixton, South London, for the now defunct Kids Company (update 2021: now exonerated.) Thought I’d end up coaching skateboarding or computer coding. Nope. I like to be lead by the young people’s interests. Turns out inner-city kids from poor backgrounds are most interested in… GETTING RICH. Makes sense when you think about it. Ended up giving seminars about ISAs and pension plans to a hoodie. But that’s a topic for another blog post.

UPDATE 2019-05-15:

Recently in a job interview I was asked ‘what is the main advantage of React over other libraries?’.

I said ‘community?’.

I didn’t get the job.

So I asked Dan Abramov, who actually invented much of React.

He said: ‘I honestly couldn’t answer that question’.

I felt better.

Then Dan said the main advantage of React is probably a couple of new features coming out called concurrent mode and suspense…

You may also like: my blog post on If you were to start React all over again what would you do? [NSFW]

- ← Previous

About This Blog - Next →

The world of tech start-ups. A glorious shitshow.